PropNex Picks

|November 28,2024Are Mass-Market Condos Still Profitable?

Share this article:

Homeowners these days have greatly surpassed homeowners of previous generations. They are usually savvy and actually do understand how their property can be a great instrument for their retirement later in life. It was and it has always been one of our great Singaporean dream to live in a condominium, that is why we still see phenomenal results for new launches with the recent Emerald of Katong selling out 99% at launch!

That being said, we all have our ideals of a dream home, some want to busk in the excitement in the Core Central Region (CCR), others might prefer a laid back seafront house to enjoy beautiful scenes of a sunset. But when you pitch ideals and reality especially when it comes to the price tag, people might settle for otherwise instead.

That is why when most people are thinking of buying their first home or looking to upgrade from an HDB apartment, they usually look to the mass market condominiums. Singapore properties broadly fall into one of these categories, mass-market, mid-market and high-end. For the purpose of today's article, we will be looking at mass market condos, understanding what kinds of demands they drive and is it a profitable asset in itself.

Mass-market condos are private residential non-landed properties found in the Outside Central Region (OCR), this excludes executive condominiums. This group is the largest and makes up almost half of the condos transacted in Singapore. Given the size of this segment, it bears a significant influence on the price movement and market dynamics to the rest of the private housing market, serving as a benchmark.

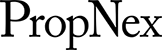

Over the span of the last 10 years, new launches in the OCR grew the most with an increase in 85.3% while the Rest of Central Region (RCR) saw pretty substantial gains as well with 78.6% growth, and CCR with the least gains out of the three, at 43.4%. Mass-market condos made almost two times gains when compared to their counterparts in the CCR segment, but remember that the entry price and quantum is on another level, so I suppose the difference in gains is comprehensible. Find out what are some reasons driving the OCR market here.

Average psf of new launch from 2014 - 2024

Seeing the overall increase is one thing, there bound to be ups and downs in the property market and surely not every project is profitable. Let's take a closer look at some mass-market projects and see how they fare. For this purpose, I have short-listed OCR projects that TOP in 2023 and must have at least 300 units and above. You must be wondering why 300 units and above, because we need to see a sizeable project with enough transactions to know more conclusively if the gains or losses are substantial or plain luck or unluckiness.

Profitability of Projects that TOP in 2023

| Project | Min. Gain | Max. Gain | District | Transaction Volume | Profitability |

| Treasure at Tampines | $25,000 | $981,000 | D18 | 458 | 100% |

| The Florence Residences | $14,000 | $728,000 | D19 | 268 | 100% |

| Parc Clematis | $102,000 | $895,000 | D5 | 202 | 100% |

| Affinity at Serangoon | $24,000 | $875,000 | D19 | 272 | 99.63% |

| Riverfront Residences | $22,000 | $850,000 | D19 | 387 | 100% |

| Sengkang Grand Residences | $30,400 | $492,088 | D19 | 63 | 100% |

| Midwood | $25,000 | $346,000 | D23 | 22 | 100% |

| Dairy Farm Residences | $126,000 | $593,100 | D23 | 11 | 100% |

(Source: Investment Suite)

So as you can see from the table above, the only project that saw unprofitable unit(s) was at Affinity at Serangoon, but that is only one of such cases. We cannot determine or know if this particular owner sold the property in a rush due to other commitments or reasons. But what we can tell is that every other mass-market project did superbly well, so well that so many of the gains, for example the one in Treasure at Tampines almost hit a million dollars in such a short span of time. Even mass-market condos have mega developments and boutique ones, which one should you go for?

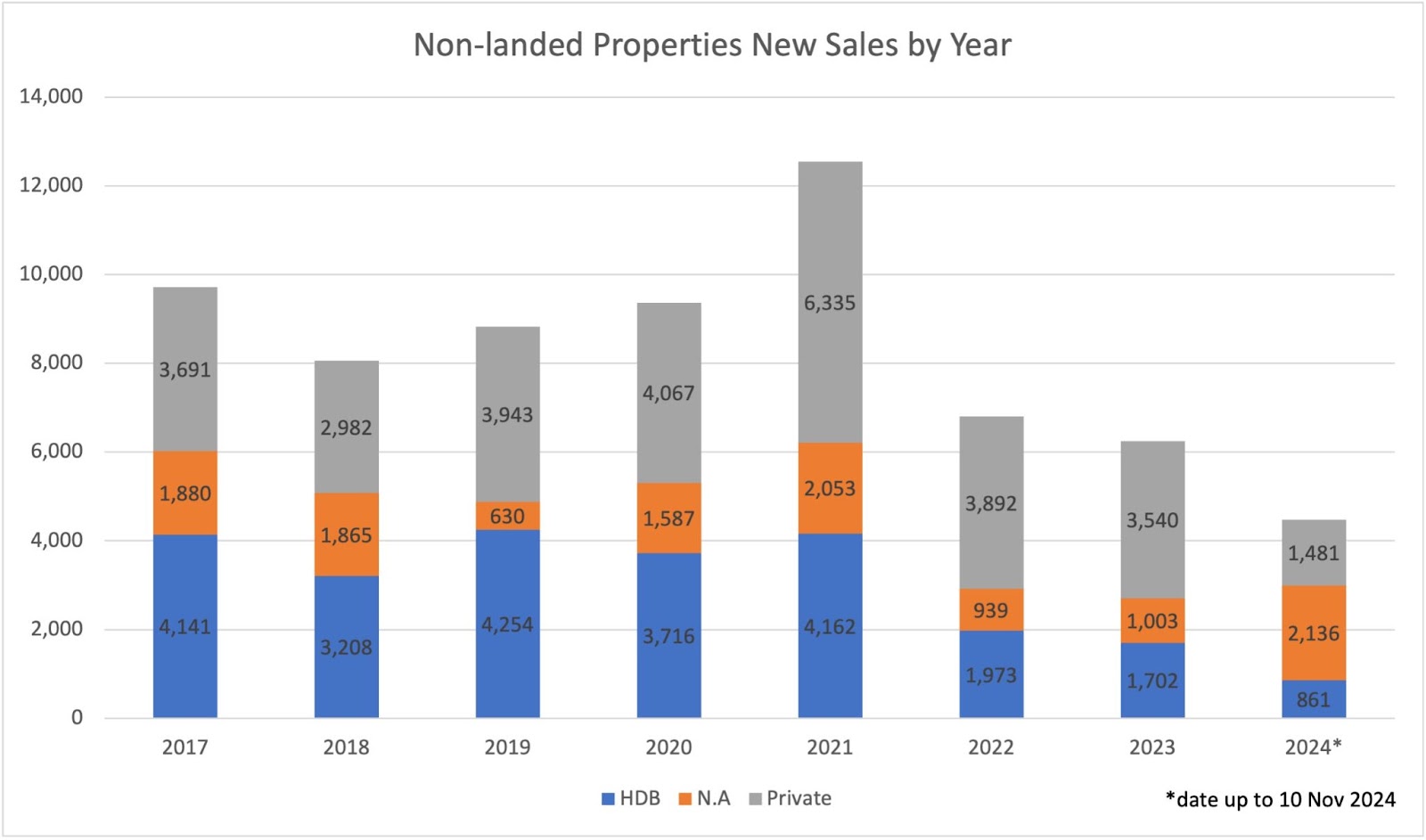

(Source: PropNex Research, URA Realis)

As you can see from the table above, there is a trend of declining HDB upgraders throughout the last few years. From 2017 up till 2019, there were more buyers from the HDB upgraders than the buyers who already owned private properties. The decline could be due to the good momentum in the private property market and also cooling measures from the government over the last few years in attempts to taper off the red-hot market.

Demand for private housing in the 3 market segments (2023)

| CCR | RCR | OCR | |

| Homebuyer's address | Non-landed units bought | Non-landed units bought | Non-landed units bought |

| HDB Address | 22.1% | 29.7% | 44.5% |

| Private Address | 77.9% | 70.3% | 55.5% |

| Total* | 100% | 100% | 100% |

*Figures were tabulated without buyers with N/A addresses

That being said, the mass-market condo remains the most popular choice of private property among HDB upgraders as it is the most affordable choice out of all the other segments. The price range for a new launch in today's market for OCR is between $1,631 psf to $2,746 psf, as opposed to the ones in RCR and CCR that ranges from $2,446 psf to $3,939 psf.

Additionally, some buyers with HDB addresses may opt to move to a condominium within the same or nearby HDB town, as they feel a sense of familiarity with their surroundings and neighbours. And other compelling reasons could be also near their parents' place or proximity to their children's school.

So back to the question, are mass-markets still profitable? Of course they are still profitable, as you can see from the examples of projects that TOP in 2023. But as you already should know, the market is fluid and things can change, so it's always a good idea to continuously educate yourself with the latest real estate movements - that I can do for you.

Seeing how profitable OCR developments actually are and can be, maybe you might want to start looking at some of your own. Don't be too hasty, there are still several factors to think of when it comes to whether you should opt for a new launch or a resale? And after that, there is also the question of whether you should go for a freehold or leasehold property. It is not as simple as choosing one and praying that it'll do well like the rest did, there are so many factors to consider isn't it?

When in doubt, always speak to a professional about it. The insights and market conditions they can provide is impeccable. Let them do the proper calculations to see what you can afford, hopefully then, you can achieve your very own piece of Singaporean dream!

Views expressed in this article belong to the writer(s) and do not reflect PropNex's position.