PropNex Picks

|February 05,2025Relatively Positive Start To 2025 For The HDB Resale Market

Share this article:

The HDB resale flat market turned in a somewhat bright start to the year, with transactions touching a five-month high in January 2025. This is a healthy performance considering the Lunar New Year holidays during the month which tend to see slower sales activity.

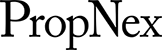

There were 2,326 HDB flats resold in January, marking a 9.6% MOM increase from 2,123 units in December 2024, while sales fell 11% YOY from the 2,621 resale flats transacted in January 2024 (see Chart 1). The HDB resale volume has generally been on a downtrend after July 2024, perhaps suggesting that the government's intervention in August 2024 - where the loan-to-value (LTV) limit for HDB housing loans were cut to 75% - is gradually working through the market. Sengkang, Tampines, and Woodlands were the top three towns with the most resale deals done during the month.

Chart 1: HDB resale volume and average resale price

Source: PropNex Research, data.gov.sg

The cooling measures, along with price resistance among buyers could have put a drag on resale flat prices. Based on transaction data, the average HDB resale prices fell marginally by 0.3% MOM to $636,059 in January - the first decline in prices, albeit slightly in six months (see Chart 1). When compared to the previous year, the average resale flat prices were up by 7.6% YOY.

In January, most flat types in mature towns posted price growths over December. Executive flats saw the sharpest average price increase at 5.5% MOM to around $999,000 in the month, supported by several units that were transacted for at least $1 million. Meanwhile, the average price of 3- and 4-room flats in mature estates inched up by 0.9% MOM and 0.7% MOM, respectively (see Table 1). However, 5-room flats bucked the trend with a 1.5% MOM decline in the average resale price.

Over in non-mature towns, 5-room resale flats garnered the highest price growth at 1.1% MOM, while that of 3-room flats rose by a marginal 0.8% MOM in January. The average resale price of 4-room and executive flats in non-mature estates fell by 1.0% MOM and 0.9% MOM, respectively (see Table 1). The price increase for 5-room resale flats in non-mature towns could be partly due to higher number of transactions done - 367 units in January against 305 units in December.

Table 1: Average HDB resale flat prices by flat type, by town classification

Mature towns | Non-mature towns | |||||

Dec-24 | Jan-25 | % change MOM | Dec-24 | Jan-25 | % change MOM | |

| 3 ROOM | $466,091 | $470,195 | 0.9% | $447,347 | $450,702 | 0.8% |

| 4 ROOM | $760,877 | $766,520 | 0.7% | $603,540 | $597,479 | -1.0% |

| 5 ROOM | $899,647 | $886,163 | -1.5% | $688,503 | $695,783 | 1.1% |

| EXECUTIVE | $943,232 | $999,349 | 5.9% | $844,993 | $837,736 | -0.9% |

Source: PropNex Research, data.gov.sg

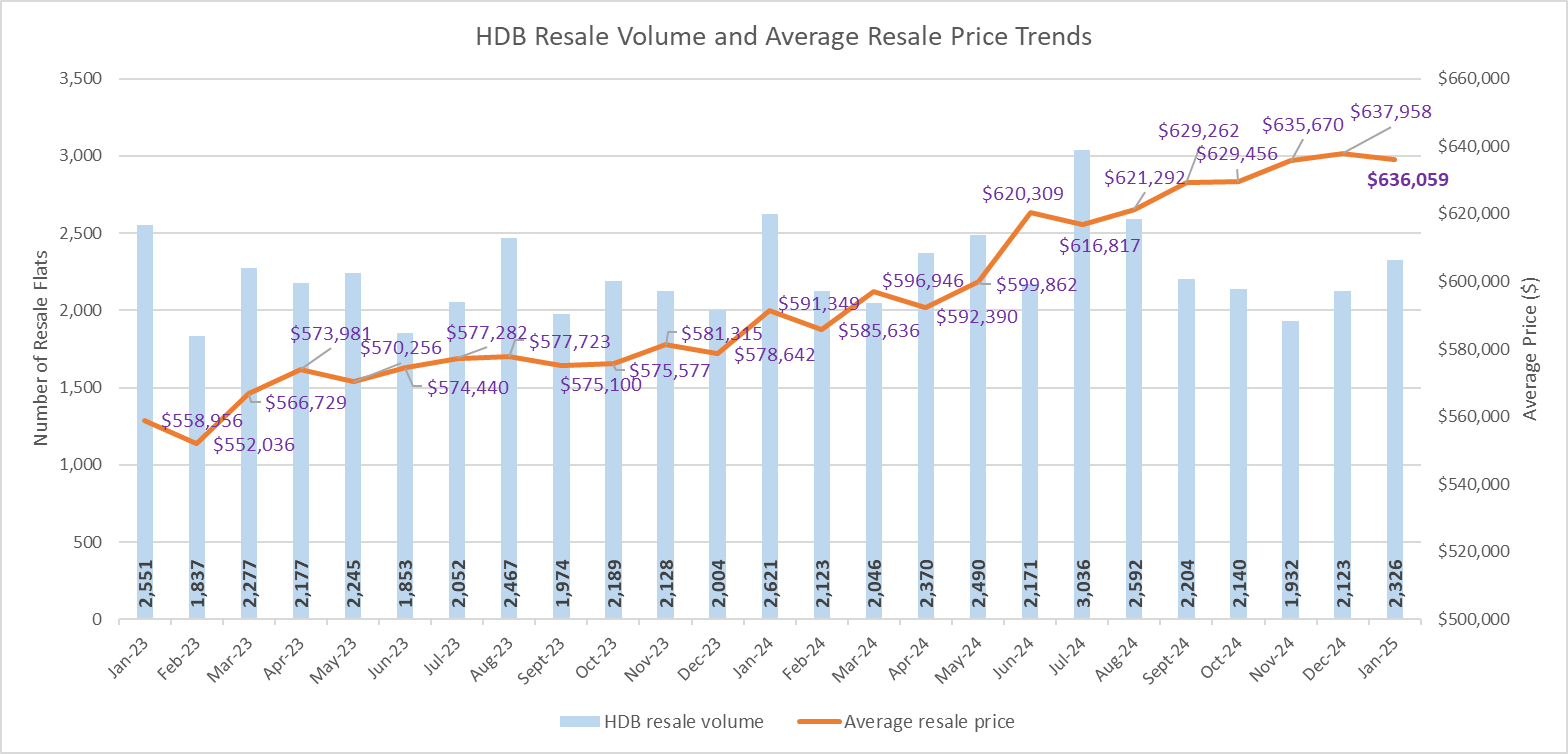

Based on the sales data, the proportion of HDB flats resold for under $500,000 in January was 24.2%, similar to that of December, while the portion of resale flats sold at prices ranging from $500,000 to just under $1 million came in at 70.6% in January, a tad lower than the 71.3% in the previous month. Meanwhile, the proportion of million-dollar resale flats inched up slightly from 4.5% in December to 5.1% in January (see Chart 2).

Chart 2: HDB resale flat transactions by price range

Source: PropNex Research, data.gov.sg

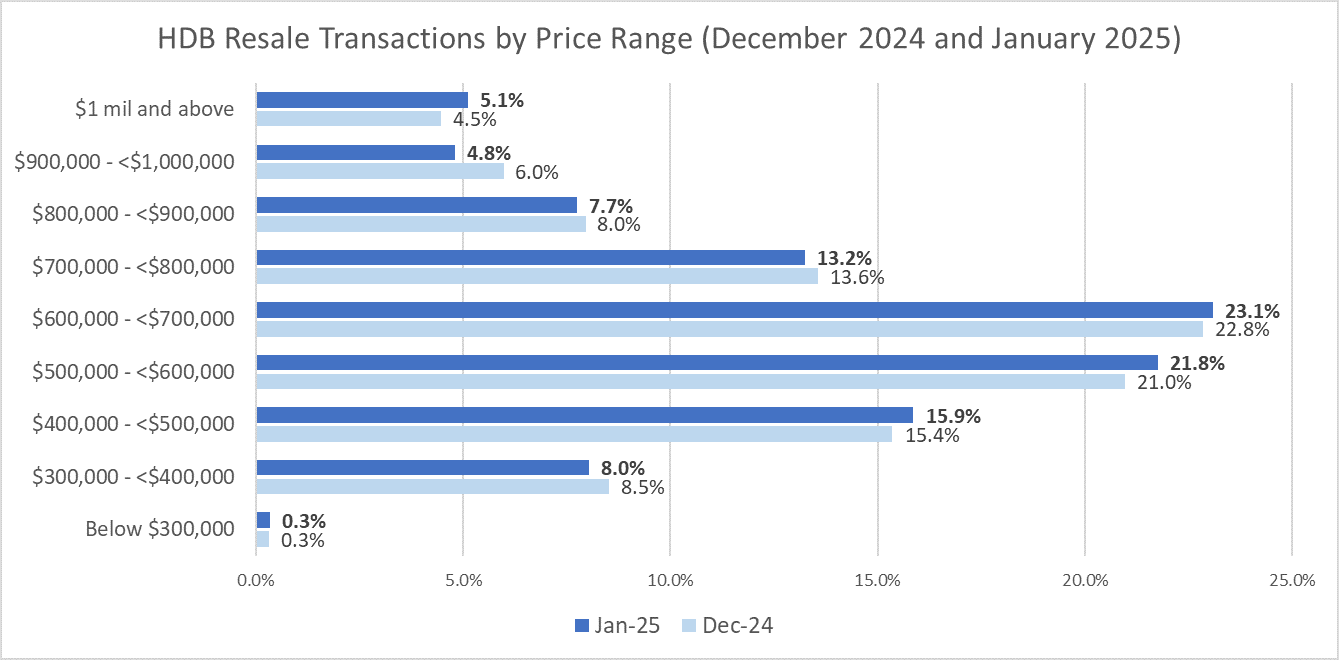

Chart 3: Number of HDB flats resold for at least $1 million by month

Source: PropNex Research, data.gov.sg

In January, there were 119 resale flats that fetched at least $1 million - up by 25% from 95 units in December. This is the second straight month where such transactions rose on a monthly basis, following a decline in October to November 2024. Overall, this is the fifth time that million-dollar resale flat sales have exceeded the 100-unit mark, the four other occasions being from July 2024 to October 2024. January's tally of million-dollar resale flats sold is one unit shy of matching the monthly high of 120 such flats transacted in July 2024.

The 119 units of million-dollar resale flats sold in January comprised 56 units of 4-room flats, 35 units of 5-room flats, and 28 executive flats. The million-dollar resale flat sales were led by Toa Payoh with 22 deals, Queenstown with 20 deals, and Bukit Merah with 14 deals. Of the 119 units, seven are located in non-mature towns of Hougang, Jurong East, Woodlands, and Yishun.

About 16% of the 119 million-dollar flats resold in January had a remaining lease of 94 years or more at the time of sale; they are located in Alkaff Crescent, Bidadari Park Drive, Circuit Road, Dawson Road, St. George's Lane, and Toa Payoh East. Meanwhile, the oldest such flats transacted in January was a 5-room unit in Marine Terrace which had a lease balance of around 49 years; it fetched $1.065 million.

The top two resale deals by price were situated in the same project in Lorong 1A Toa Payoh, where two 5-room flats spanning 117 sq m each at The Peak @ Toa Payoh were resold for $1.6 million and $1.5 million, respectively (see Table 2). Of note, the $1.6 million price tag is the highest achieved at The Peak @ Toa Payoh.

Table 2: Top 10 HDB resale flats sold in January 2025 by Transacted Price

Town | Type | Street | Storey range | Floor area (SQ M) | Lease start date | Resale price | PSF ($) |

TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 19 TO 21 | 117 | 2012 | $1,600,000 | $1,270 |

TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 22 TO 24 | 117 | 2012 | $1,500,888 | $1,192 |

BUKIT MERAH | 5 ROOM | BOON TIONG RD | 10 TO 12 | 112 | 2016 | $1,450,000 | $1,203 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 40 TO 42 | 93 | 2011 | $1,400,000 | $1,399 |

CLEMENTI | 5 ROOM | CLEMENTI AVE 3 | 28 TO 30 | 112 | 2018 | $1,400,000 | $1,161 |

BISHAN | EXECUTIVE | BISHAN ST 22 | 10 TO 12 | 150 | 1992 | $1,358,000 | $841 |

QUEENSTOWN | 5 ROOM | DAWSON RD | 10 TO 12 | 108 | 2016 | $1,340,000 | $1,153 |

BUKIT MERAH | 5 ROOM | BOON TIONG RD | 28 TO 30 | 115 | 2005 | $1,333,000 | $1,077 |

CENTRAL AREA | 4 ROOM | CANTONMENT RD | 16 TO 18 | 94 | 2011 | $1,330,000 | $1,314 |

TOA PAYOH | 5 ROOM | LOR 1A TOA PAYOH | 13 TO 15 | 110 | 2012 | $1,308,888 | $1,105 |

Source: PropNex Research, data.gov.sg

PropNex expects the number of million-dollar flat sales to remain elevated in 2025, as well-located flats with superb attributes continue to be sought-after by prospective buyers. Overall, with the cooling measures in place, the continued injection of a sizable number of new flats, and price resistance among buyers, we expect HDB resale prices could grow at a slower pace this year, to the tune of 5% to 7% in 2025 compared with the 9.7% increase in 2024.

Sign up for the PropNex Property Wealth System Masterclass to unlock opportunities in the real estate market. Contact a PropNex salesperson to find out more about resale HDB market trends.